New Rule: Reporting Ownership of your LLC and other Business Entities

Beginning on January 1, 2024, many companies in the United States will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the company. They must report the information to the Financial Crimes Enforcement Network (FinCEN). FinCEN is a bureau of the U.S. Department of the Treasury.

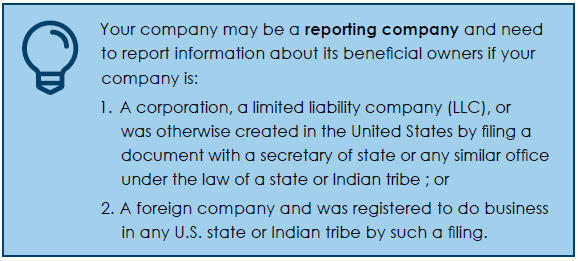

Who Has to Report?

Companies required to report are called reporting companies. Reporting companies may have to obtain information from their beneficial owners and report it to FinCEN.

When Do I Report?

Reports will be accepted starting on January 1, 2024.

If your company was created or registered before January 1, 2024, you would have until January 1, 2025, to report BOI.

If your company is created or registered on or after January 1, 2024, you must report BOI within 30 days of notice of creation or registration.

Any updates or corrections to beneficial ownership information you filed with FinCEN must be submitted within 30 days.

Penalties for Not Filing

The willful failure to report complete or updated beneficial ownership information to FinCEN or the willful provision of or attempt to provide false or fraudulent beneficial ownership information may result in civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure.

In 2021, Congress enacted the Corporate Transparency Act. This law

creates a beneficial ownership information reporting requirement as part

of the U.S. government’s efforts to make it harder for bad actors to hide or

benefit from their ill-gotten gains through shell companies or other opaque

ownership structures.